CENTURY 21 Alliance Realty Group

Real Estate Services in New York's Hudson Valley and Western Connecticut

-

Wappingers(845) 297 4700(845) 297 8178

-

Lagrange(845) 485 2700(845) 485 2703

-

New Paltz(845) 255 6163(845) 255 6757

-

Brewster(845) 279 7700

-

Hyde Park(845) 233 4634(845) 233 4633

-

Commercial Division(845) 297 4700(845) 567 8333

Most would-be home buyers spend a lot of time on line looking at potential homes to buy, but not all of them put themselves in the position to be taken seriously by sellers and lenders.

Most would-be home buyers spend a lot of time on line looking at potential homes to buy, but not all of them put themselves in the position to be taken seriously by sellers and lenders.  Did you know that nearly one-third of all homes sold last year were purchased by single persons? Many single women and men are buying homes on their own. In fact, according to the National Association of Realtors® single women accounted for 21% of all home purchases last year, and single men accounted for approximately 10%.

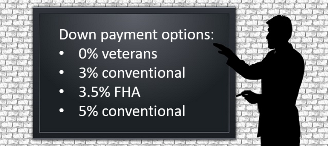

Did you know that nearly one-third of all homes sold last year were purchased by single persons? Many single women and men are buying homes on their own. In fact, according to the National Association of Realtors® single women accounted for 21% of all home purchases last year, and single men accounted for approximately 10%.  Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.  It's very possible that the best first home for you may be a multi-family home. Having a tenant to help pay your mortgage can really pay off.

It's very possible that the best first home for you may be a multi-family home. Having a tenant to help pay your mortgage can really pay off. You found a house with great potential in the perfect location, but it needs a lot of work. You may want to consider a renovation loan.

You found a house with great potential in the perfect location, but it needs a lot of work. You may want to consider a renovation loan. So you've been looking online for quite some time now for the perfect home in the perfect location, and you finally think you found it. But . . . it already has an accepted pending contract.

So you've been looking online for quite some time now for the perfect home in the perfect location, and you finally think you found it. But . . . it already has an accepted pending contract.