The good news for buyers is that mortgage interest rates continue to hold below 4%.

The good news for buyers is that mortgage interest rates continue to hold below 4%.

Freddie Mac's weekly survey of lenders showed that for the week ending January 7, 2016, the average rate for a 30-year fixed-rate mortgage was 3.94% with an average of 0.6 point, and the 15-year fixed-rate mortgage averaged 3.26% with an average of 0.5 point.

Those are average rates, not the rates that everyone will get. Understanding the factors used to determine the interest rate that you may be offered are important to help you make good decisions. What are they?

-

Credit Score

-

Home Location

-

Home Price and Loan Amount

-

Down Payment

-

Loan Term

-

Interest Rate Type

-

Loan Type

The Consumer Financial Protection Bureau has a thorough explanation of how all these factors work together to determine the interest rate and an interactive tool to help you understand how interest rates change as each factor changes. The more you know about it, the better equipped you will be to find the best mortgage to fit your needs (and save you money!).

Attaining a perfect credit score of 850 isn't easy; after all, that's like graduating from college with a 4.0! Luckily, all scores of 760 and above are considered to be in the best credit score range. If your credit score is in this category, then CONGRATULATIONS! You've obviously done some things right to get it there! As a result, lenders really want your business and will therefore offer you their best products at their lowest interest rates.

Attaining a perfect credit score of 850 isn't easy; after all, that's like graduating from college with a 4.0! Luckily, all scores of 760 and above are considered to be in the best credit score range. If your credit score is in this category, then CONGRATULATIONS! You've obviously done some things right to get it there! As a result, lenders really want your business and will therefore offer you their best products at their lowest interest rates.  Are you under the impression that the credit scores you purchase online from Equifax, TransUnion or Experian are what lenders use to approve and price a home loan?

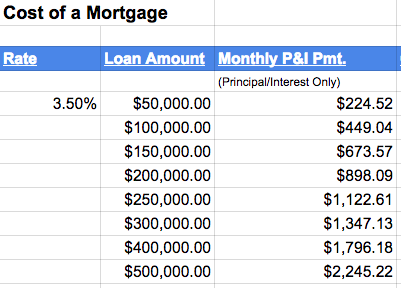

Are you under the impression that the credit scores you purchase online from Equifax, TransUnion or Experian are what lenders use to approve and price a home loan? Mortgage interest rates are amazingly low right now. If you are thinking about purchasing your first home, or considering selling and buying something different . . . well, now might be the BEST time to make your move. The cost of a mortgage is about as affordable as it gets.

Mortgage interest rates are amazingly low right now. If you are thinking about purchasing your first home, or considering selling and buying something different . . . well, now might be the BEST time to make your move. The cost of a mortgage is about as affordable as it gets.  The good news for buyers is that mortgage interest rates continue to hold below 4%.

The good news for buyers is that mortgage interest rates continue to hold below 4%.