According to a recent National Association of REALTORS® survey, the group of Americans referred to as 'Millennials', 18 to 34 year olds, made up 32% of the home buying market last year. As this group matures, it is predicted that they will become an even larger group of homeowners than the 'Baby Boomers' . . . there are more of them.

According to a recent National Association of REALTORS® survey, the group of Americans referred to as 'Millennials', 18 to 34 year olds, made up 32% of the home buying market last year. As this group matures, it is predicted that they will become an even larger group of homeowners than the 'Baby Boomers' . . . there are more of them.

Typically this group of young home buyers do their research on line to learn about home buying ins and outs, they pretty much know what they want, where they want to live, and have found homes on line that they want to see. They are busy, want to cut to the chase, and rely on their real estate agent to handle all the details more than any other group of buyers.

Rising rents, new low down payment loan options, the reduction in private mortgage insurance, and the improving job market have all been major contributing factors driving young people to purchase their own home. Here are a few interesting statistics about the 'Millennial' buyers:

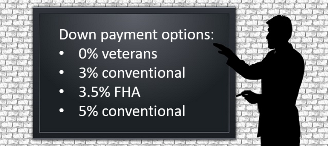

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.  According to a recent National Association of REALTORS® survey, the group of Americans referred to as 'Millennials', 18 to 34 year olds, made up 32% of the home buying market last year. As this group matures, it is predicted that they will become an even larger group of homeowners than the 'Baby Boomers' . . . there are more of them.

According to a recent National Association of REALTORS® survey, the group of Americans referred to as 'Millennials', 18 to 34 year olds, made up 32% of the home buying market last year. As this group matures, it is predicted that they will become an even larger group of homeowners than the 'Baby Boomers' . . . there are more of them.